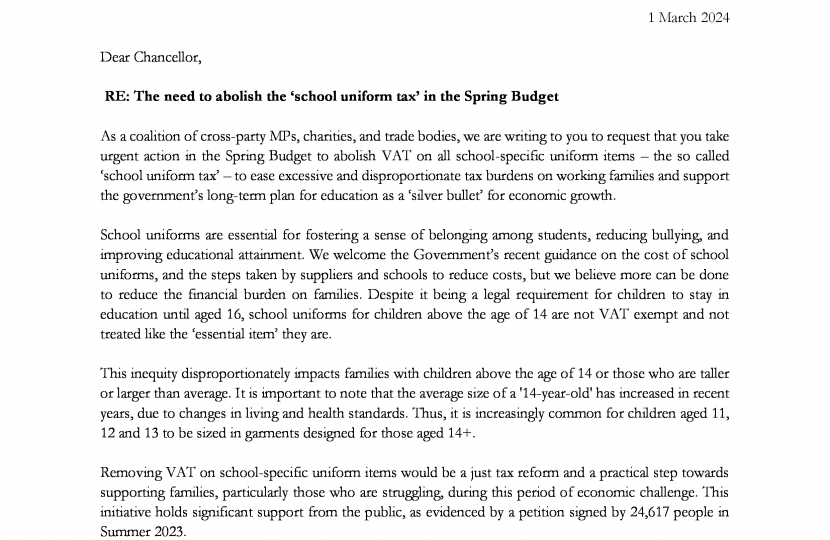

Dear Chancellor,

RE: The need to abolish the ‘school uniform tax’ in the Spring Budget

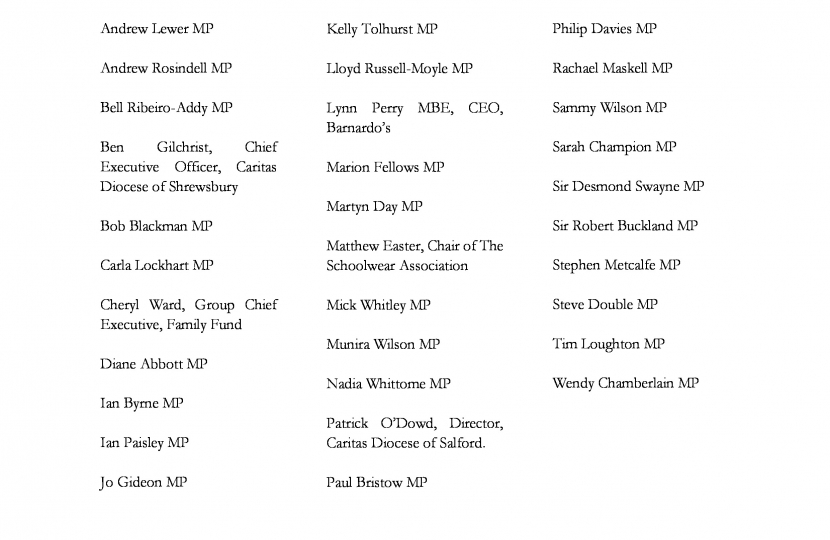

As a coalition of cross-party MPs, charities, and trade bodies, we are writing to you to request that you take urgent action in the Spring Budget to abolish VAT on all school-specific uniform items – the so called ‘school uniform tax’ – to ease excessive and disproportionate tax burdens on working families and support the government’s long-term plan for education as a ‘silver bullet’ for economic growth.

School uniforms are essential for fostering a sense of belonging among students, reducing bullying, and improving educational attainment. We welcome the Government’s recent guidance on the cost of school uniforms, and the steps taken by suppliers and schools to reduce costs, but we believe more can be done to reduce the financial burden on families. Despite it being a legal requirement for children to stay in education until aged 16, school uniforms for children above the age of 14 are not VAT exempt and not treated like the ‘essential item’ they are.

This inequity disproportionately impacts families with children above the age of 14 or those who are taller or larger than average. It is important to note that the average size of a '14-year-old' has increased in recent years, due to changes in living and health standards. Thus, it is increasingly common for children aged 11, 12 and 13 to be sized in garments designed for those aged 14+.

Removing VAT on school-specific uniform items would be a just tax reform and a practical step towards supporting families, particularly those who are struggling, during this period of economic challenge. This initiative holds significant support from the public, as evidenced by a petition signed by 24,617 people in Summer 2023.

The proposed change applies only to school-specific uniform items - such as branded blazers and ties – and won't affect broader clothing markets. Additionally, safeguards such as adding a line into the government’s statutory guidance on school uniforms, can ensure the savings are passed on directly to consumers. Further information on how the change would operate can be found in The Schoolwear Association’s Spring Budget submission.

We wholeheartedly believe that removing VAT on school uniforms is a sensible and compassionate policy that aligns with the government's commitment to raising education standards and alleviating financial pressures on families through removing excessive and disproportionate taxation. I urge you to consider this proposal seriously for the Spring Budget.

With all this in mind, we hope that you take action to abolish this tax as soon as is possible. We look forward to hearing back from you in due course.