Dear Chancellor,

I am writing as Chair of the All-Party Parliamentary Beer Group, with the support of a significant number of my colleagues. Members of the APPBG engage with landlords, pubs, and brewers throughout their constituencies and the group formally engages with 60 companies across the breadth of the brewing and pub sector to gain further insights. A full list is enclosed at Annex 1.

As you know, the brewing and pub sector, along with wider hospitality, is well placed to deliver solid economic returns for the UK. It is an industry that is at the heart of our local communities, providing safe social spaces which bring people together for all kinds of occasions, creating connections, and supporting our wellbeing. However, operators remain under significant pressure, with the cost of conducting business leading to a reduction of 3766 licenced premises across the hospitality sector. This equates to 3.6 per cent of the sector in one year. The loss of a pub has severe ramifications for local communities and high streets in terms of economic value, employment, and community cohesion.

Creating the right economic and fiscal conditions to enable the industry to thrive is crucial. Investment in beer and pubs at this time will yield positive outcomes for economic growth in our towns, cities, and rural communities across the UK. The industry is keen to engage with the government. One example is the joint initiative with DWP aimed at bringing people far from the workplace into employment through the Hospitality Apprenticeship Pilot. Working with Job Centres, the industry coordinates activity to prepare candidates for apprenticeships. This scheme is actively bringing people into the workforce and is a great example of the positive impact the industry can have on supporting levelling up and providing employment opportunities. This came together as a result of a recruitment challenge and their recognition that level 3 apprenticeships were not suitable to their recruits in the first instance.

Your previous support has been very much appreciated and is recognised, and as we move towards the Spring Budget, I would take this opportunity to highlight the following areas for consideration:

Capping the standard business rates multiplier. This is due to be increased in April at more than twice the rate of underlying inflation. The sector continues to call for an overhaul of the business rates system but recognise that this is unlikely in the short term.

A cut in overall Beer Duty. This would help mitigate costs being passed on to consumers and in doing so, support efforts to reduce inflation and also start to redress the duty level which remains one of the highest in Europe.

An extension of Draught Relief in pubs. The draught duty differential is currently 9.2%. Widening this further under the Brexit Pubs Guarantee would also help support pubs at this challenging time and benefit consumers. This would recognise the role pubs play in communities and in supporting responsible drinking. It would also help prevent further decline of high streets and maintain community hubs in rural areas.

A reduction in Employer NI contributions. The implementation of the NLW/NMW increases will add to staff costs not just in terms of the uplift but will also impact as businesses try to maintain differentials. A reduction in Employer NI contributions would help to ease this cost burden.

CBILS flexibility. Extending or permitting the rescheduling of the loans would ease the pressures on the hospitality significantly. The current repayment is a challenge with the increased interest rates and banks are refusing to reschedule because of the guarantees they would lose.

The industry is also facing additional costs from the introduction of new packaging regulation, notably the Deposit Return Scheme. I am working with DEFRA on this but as it stands, the additional costs incurred will increase the rates at which licenced premises will close.

This is a sector keen to invest. With policies that will encourage investment further, it has the capacity to respond immediately with employment, skills, and regeneration of the High Street amongst many other social benefits.

Thank you for your consideration, and along with the industry, we look forward to working with you.

Yours sincerely

The Rt Hon Alun Cairns MP Vale of Glamorgan

Peter Aldous MP

Caroline Ansell MP

Sarah Atherton MP

Bob Blackman MP

Sir Peter Bottomley MP

Rt Hon Sir Graham Brady MP

Rt Hon Robert Buckland MP

Rt Hon Sir Geoffery Cox MP

Rt Hon Stephen Crabb MP

Virginia Crosbie MP

Dr James Davies MP

Dehenna Davison MP

Steve Double MP

Flick Drummond MP

Rt Hon George Eustice MP

Sir Michael Fabricant MP

Simon Fell MP

George Freeman MP

Jonathan Gullis MP

Darren Henry MP

Dr Neil Hudson MP

Simon Jupp MP

Rt Hon Sir Greg Knight MP

Kate Kniveton MP

Andrew Lewer MP

Rt Hon Sir Brandon Lewis MP

Marco Longhi MP

Jonathan Lord MP

Robin Millar MP

Tom Randall MP

Selaine Saxby MP

Greg Smith MP

Henry Smith MP

Jane Stevenson MP

Julian Sturdy MP

Derek Thomas MP

Justin Tomlinson MP

Craig Tracey MP

Steve Tuckwell MP

Rt Hon Shailesh Vara MP

Robin Walker MP

Giles Watling MP

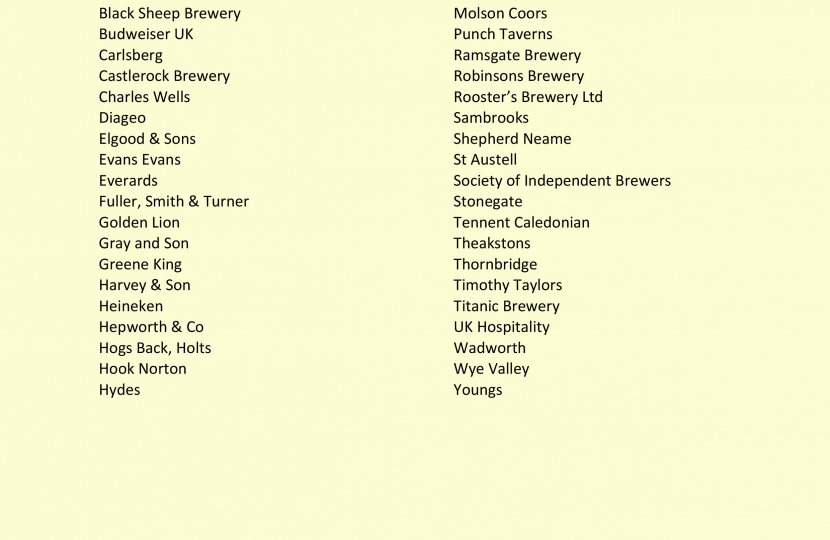

Annex 1: List of Supporters of the All-Party Parliamentary Beer Group

Admiral

Innis & Gunn Adnams

J W Lees

Amber Taverns

Kurnia Group

Asahi

Laine Pub Co

Barter Inns

Lancaster Brewery

Batemans,

Lincoln Green

Bathams

Lucky Saint

Bavaria

Marstons

Beds and Bars

McMullen Black Sheep Brewery UK

Molson Coors

Budweiser UK

Punch Taverns

Carlsberg

Ramsgate Brewery

Castlerock Brewery

Robinsons Brewery

Charles Wells

Rooster’s Brewery Ltd

Diageo

Sambrooks

Elgood & Sons

Shepherd Neame

Evans Evans

St Austell

Everards

Society of Independent Brewers

Fuller, Smith & Turner

Stonegate

Golden Lion

Tennent Caledonian

Gray and Son

Theakstons

Greene King

Thornbridge

Harvey & Son

Timothy Taylors

Heineken

Titanic Brewery

Hepworth & Co

UK Hospitality

Hogs Back, Holts

Wadworth

Hook Norton

Wye Valley

Hydes

Youngs